What if we mentioned that there was a approach to repay your scholar loans with out even realizing it? Properly, that could possibly be true if you happen to use SLOAN to assist handle, observe and repay your scholar loans. Combining buy round-ups, peer to look giving and environment friendly compensation strategies, SLOAN can theoretically allow you to repay your scholar mortgage years early, with out being an enormous monetary burden.

Table of Content

- ultimate student loan app

- buy app downloads and installs

- world app ranking

- buy ios reviews

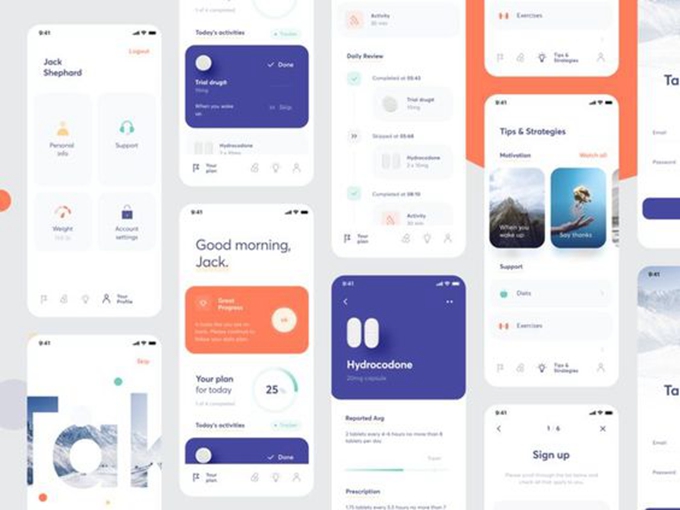

The intuitive dashboard helps you retain observe of your mortgage – or loans – with all of the important data you want proper at your fingertips. You may take a look at quantity owed, compensation schedule, rates of interest and extra. You can also make one-off funds or arrange recurring funds, utilizing their fee methods like ‘highest curiosity first’ to repay your loans in essentially the most environment friendly manner.

With regards to getting the money collectively to pay your mortgage, SLOAN is a superb software. Probably the most helpful of its cash saving options is – in our opinion – the acquisition roundups. Each time you make a credit score or debit card buy, the full is rounded up and the distinction is paid straight in the direction of your scholar mortgage. All of the coffees, amazon purchases and cinema tickets add up over time, and so will the change collected by the app. Count on to save lots of $70 or extra monthly utilizing this characteristic alone. You can even get your family and friends to do the identical, which is able to increase your financial savings considerably!

One other manner it can save you much more is thru peer to look giving. If buddies, household or the SLOAN group are feeling beneficiant sufficient, they’ll contribute straight in the direction of your scholar mortgage repayments on a one-off or recurring foundation. It’s an effective way to cut back the monetary burden on your self! There’s additionally an worker plan the place you may get your employers to enroll and contribute in the direction of it, too, with the total confidence that each one cash given can solely go in the direction of your mortgage.

SLOAN combines a number of options – from mortgage administration to environment friendly compensation and superior saving strategies – into one highly effective package deal that might actually allow you to repay your mortgage years earlier.