63% of American smartphone customers have not less than one monetary software on their cellphone, in response to Bankrate. These numbers offered in a examine additionally discovered that 70% of those that have a banking app verify it not less than as soon as per week. The way in which we transact our cash has modified steadily over the centuries however has altered dramatically within the final decade owing to technological developments. Think about blockchain, as an example, which is the expertise that paved the best way for the creation, widespread use and acceptance of cryptocurrency as a safe type of cost amongst massive organizations.

Table of Content

- Mobile Money Apps

- buy installs google play

- android app ranking

- app reviews android

Certainly, the usage of blockchain has performed a big half in responding to the rising want for extra safety whereas transacting on-line. Along with blockchain expertise, there are a selection of purposes that should be highlighted for the position they proceed to play in addressing the growing questions that cash within the digital period pose.

Why You Want Monetary Apps

We’re an ever rising and growing species. Think about the truth that within the olden ages, shells had been thought of a type of cash and so they facilitated commerce between folks and even communities. The one fixed throughout the centuries and the altering face of cash from shells, to gold and finally to paper forex is the continuous seek for larger ease, extra effectivity, and stronger safety whereas transacting, all of that are catered to by monetary apps. Due to all these advantages, it’s needed that we encourage all ranges of society to be taught and embrace expertise of their dealings with cash. That is very true for senior residents who could also be a bit cautious of shifting to cashless transactions. Nonetheless, as soon as they perceive how a lot simpler it’s to price range and make purchases this manner, they’ll embrace the twenty first Century approach of dealing with cash. Now the query is, which monetary apps ought to you’ve gotten in your cellphone?

Find out how to Determine the Finest App for You

Finance apps may be divided into varied teams. Some divide them into two: tax preparation apps and cash administration apps. Nonetheless, for the aim of this text, it’s simpler and extra informative to divide them into 4 classes: price range monitoring apps, monetary assistant apps, mortgage calculator apps, and spending and saving apps. Ideally, it is best to have these 4 several types of apps in your cellphone for optimum comfort, however it’s possible you’ll discover an app that gives all 4 options although at various effectivity. The cardinal rule when deciding on a monetary app is to search out one that’s credible, safe, clear and related.

Monetary Budgeting Apps

The world of budgeting apps grows each day. Budgeting apps mean you can successfully break down, then construct up your funds. price range takes away the complexity of managing your private finance life by highlighting the gadgets taking over probably the most of your cash or the pointless merchandise it’s possible you’ll be spending cash on. Builders on this app class have made it potential for these apps to spice up numerous options. For example, there are budgeting apps that sync to your checking account permitting you to trace the cash going out and in. They’ll routinely generate a price range for you primarily based in your revenue and spending in addition to provide you with a warning when payments are due. In addition they present tips about methods to enhance your spending habits and supply methods on methods to enhance your credit score profile.

Cash Saving Apps

One of many largest challenges folks face on the subject of managing their cash is methods to save. Nonetheless, expertise has are available in to unravel this drawback. Cash saving apps work in several methods to avoid wasting your cash, maybe one of many extra unconventional of those means is that some apps take spare change out of your linked debit and credit score accounts and redirect it to your funding accounts. Some cash saving purposes additionally make the most of algorithms to determine how a lot cash you possibly can comfortably save and routinely redirects that quantity into your financial savings account.

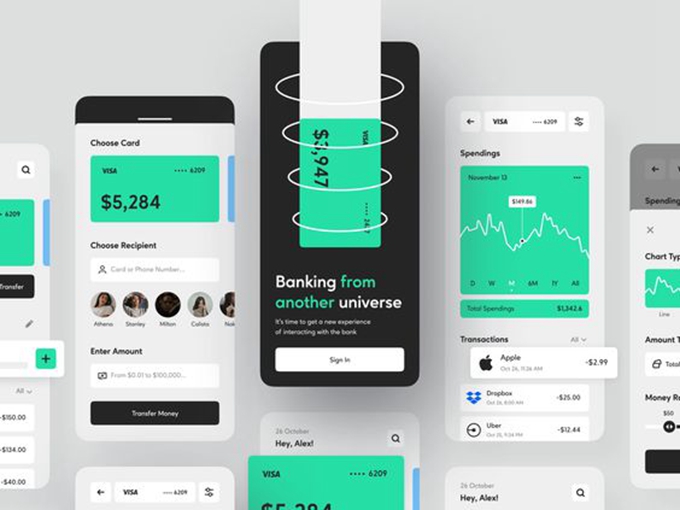

Cell Banking Apps

Cell banking has been advancing steadily over the previous decade. One of many earliest options of cellular banking was the power to verify your financial institution deposit which was on the time thought of leading edge. Nonetheless, developments in expertise have birthed a bunch of latest options together with seamless cash switch, the choice to pay payments and ATM locators. The brand new definition of leading edge now consists of monitoring accounts from totally different monetary establishments, built-in budgeting platforms, and digital pockets capabilities.

The most effective apps on this market increase numerous options that embrace these listed above. Nonetheless, in addition they embrace extra options that enhance the effectivity of your cellular banking. Certainly one of these is the power to commerce shares and monitor funding efficiency by your cellphone. In addition they mean you can obtain an extra built-in app to regulate your card. This lets you customise your debit card and set spending limits for it.

The change of cash from one kind to a different kind is without doubt one of the most essential chapters in human historical past. Nonetheless, the shift in how we switch, handle and save this cash may be very a lot part of our current and we should always embrace the gradual shift in direction of cellular finance.