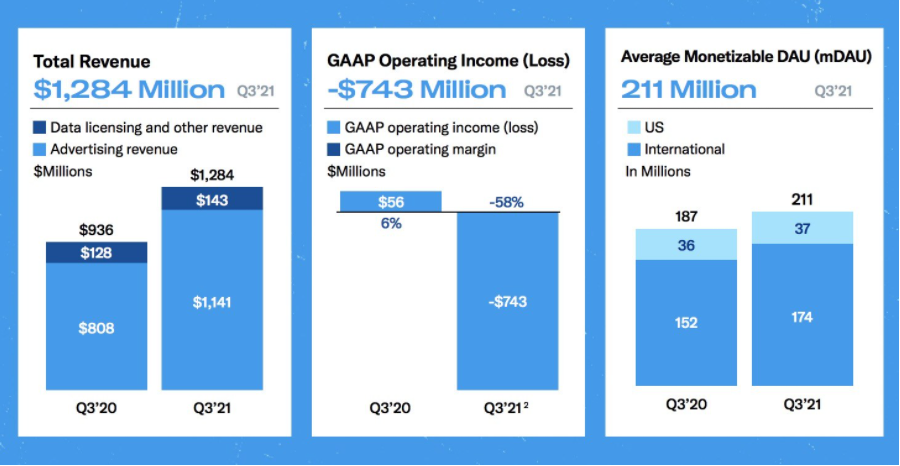

Twitter increased revenues and the number of users during Q3 2021, according to the company’s latest results. Monetizable daily active users were up 13% from the previous year to 211 million. Much of that is due to international growth. Daily active users in the US remained stagnant at 37 million.

Table of Contents

- Twitter increases daily active users and revenues

- cheap aso services

- buy ratings android

- google play store search optimization

Twitter increases daily active users and revenues in Q3 2021

Twitter has tested a range of new features and functions to simplify and diversify its platform in 2021.

“In Q3, we began testing simplified interest selection during onboarding, making it easier to go from broad categories of interest to the specific subjects that new customers care about most. Early results show a more than 35% increase in the number of new customers who tell us their interests as a result. We also made it easier for new customers to sign up in Q3 with single sign-on, allowing people to sign up or log into Twitter with their Google Account or Apple ID.”

Total revenues jumped 37% to $1.28 billion, from $936 million in Q3 2020. Total US revenue was $742 million, an increase of 45%. Total international revenue was $542 million, an increase of 28%, or 27% on a constant currency basis. Japan remained the app’s second-largest market in terms of revenue contributing 12% of the total.

Advertising revenues jumped 41% to $1.14 billion.

Twitter said that its updated Learning Period model lead to a 36% increase in the number of campaigns that achieved the minimum viable threshold for campaign performance and advertiser retention.

Earnings Highlights

Revenue was $1.28 billion in Q3, up 37% year over year, reflecting strong performance across all major products and geographies. Our Q3 operating loss of $743 million includes a one-time litigation-related net charge of $766 million, as well as ongoing investments. Adjusted operating income, which excludes the one-time litigation-related net charge, was $23 million.

Total revenue was $1.28 billion in Q3, an increase of 37%. Total US revenue was $742 million, an increase of 45%. Total international revenue was $542 million, an increase of 28%, or 27% on a constant currency basis. Japan remains our second-largest market, growing 20% and contributing $159 million, or 12% of total revenue in Q3.

Total advertising revenue was $1.14 billion, an increase of 41%. Data licensing and other revenue totaled $143 million, an increase of 12%. Our Q3 operating loss of $743 million includes a one-time litigation-related net charge of $766 million, as well as ongoing investments.

This resulted in an operating margin of -58% in Q3, compared to operating income of $56 million and an operating margin of 6% for the same period in 2020. Adjusted operating income, which excludes the $766 million litigation-related net charge, was $23 million, reflecting an adjusted operating margin of 2%. We incurred a net loss

of $537 million in Q3, representing a net margin of -42% and diluted EPS of ($0.67).

Average monetizable DAU (mDAU) reached 211 million, up 13% year over year, accelerating from 11% year over year growth in Q2, driven by ongoing product improvements and global conversation around current events.

In Q3, we continued making Twitter the best place for people to keep up with and discuss their interests. 230 million accounts now follow at least one Topic, and we added more than 2,300 Topics in Q3, bringing the total number of Topics that people can follow up to 11,800 across 11 languages. We also continued to significantly improve the personalization of Topic recommendations and notifications for existing customers.

For new customers, Topics are an important part of successful onboarding. We’ve found that new customers who follow Topics are more engaged on day one and are more likely to log in on day two and day three. In Q3, we began testing simplified interest selection during onboarding, making it easier to go from broad categories of interest to the specific subjects that new customers care about most. Early results show a more than 35% increase in the number of new customers who tell us their interests as a result. We also made it easier for new customers to sign up in Q3 with a single sign-on, allowing people to sign up or log in to Twitter with their Google Account or Apple ID.

Twitter is where people go to have real conversations about what’s happening — and creators are responsible for starting, influencing, and amplifying a large percentage of those conversations. By helping creators make money, we provide a clear and direct incentive for them to invest more time and money developing content for Twitter.

To that end, in Q3, we launched three new monetization products for creators: Tips, Super Follows, and Ticketed Spaces. We also started to roll out Communities, an easy way to find and connect with people who have similar interests. When people join a Community, they can Tweet directly to that group instead of all followers, and only members in the same Community can reply and join the conversation, keeping the conversation intimate and relevant.

Today, a person must apply to start a Community, but in the coming months, we’ll allow more people to create communities so that everyone can talk about their interests, whatever they are.

We continue to enhance the global conversation on Twitter with live and on-demand video content. Examples from Q3 include:

• A multi-year global extension of our existing partnership with Dow Jones Corporation, which includes a renewal of the successful WSJ What’s Now series, as well as new Barrons, Investor’s Business Daily, and MarketWatch content on Twitter.

• A global deal with IMG Fashion Events & Properties, a division of the world’s leading entertainment and events company, covering Fall 2021 and Spring 2022 Fashion Weeks, including live streams, highlights, and Spaces.

• A deal with Fox Sports to bring the best of college football content to Twitter with real-time highlights, opening drive “live” streams, as well as a fan-powered “Alternate Camera Angle”where fans get to choose how to watch one of the best games of the week.

Related tips: